What is the goal for your portfolio?

Submitted by Desmond Wealth Management, Inc. on October 16th, 2015

When talking with prospective clients about their portfolio, the answers I get to the question, “What is the goal for your portfolio?”, are often one of these four common statements:

- To make money.

- To not lose money.

- To beat the market (meaning a benchmark such as the S&P 500).

- To beat my brother-in-law’s returns.

But with further thought, is this truly the goal of your portfolio?

When we discuss portfolio management and allocations with our clients, our focus is not on any of the above reasons. We focus on how your portfolio helps you achieve your goals.

In order to have an accurate measurement of the ‘performance’ of your portfolio, you have to have clear goals first. Then, you can assess how your portfolio is helping you go out and actually live those goals.

Our goal at Desmond Wealth is to help you “build your ideal future,” and reach your life and financial goals.

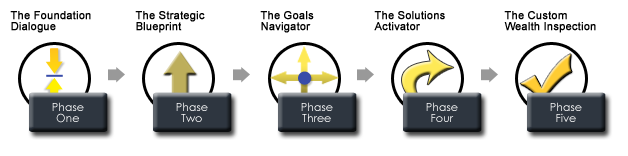

We have a robust five-step process that we take our wealth management clients through. The first step is to create a clear vision of your ideal future. Perhaps you want to retire early, to travel the globe, pay for college for your grandkids, or leave a legacy for multiple generations. Every individual has a unique vision of their own personal ideal future, and our job is to help you dig deep and crystalize your vision and make a plan that turns it into reality.

That sounds simple, but it can be complicated.

As your wealth grows, so do your dreams for the future. While most successful people have done some planning, many still lack confidence and a clear vision of their ideal future. Often it’s difficult to prioritize your desires and understand the impact of one over another.

Without expert guidance, your financial affairs may become excessively complex. Over time your investments may have become disorganized and fragmented, or maybe lack proper diversification and take too much risk. Expenses may be too high. These factors can result in paying too much tax, receiving insufficient income, and incurring needless complexity and stress. This can prevent you from enjoying life to the fullest, and leave a nagging worry at the back of your mind.

It’s a process - not an event.

DWM’s annual Client Wealth InspectionTM will ensure your financial plan and investments are closely aligned with your ideal vision of the future. It is important to note that it is a process, not a one-time event. We help you create and implement your plan. But the fact that we work with you to continually revisit the plan and make changes along the way is just as important, especially as critical financial events (planned and unplanned) occur. Examples of these events could be the birth of a child, retirement, a critical illness, or the sale of a business.

We work with you to maximize your assets, reduce taxes, enhance the quality of your life, and realize your personal and financial goals. So the next time your neighbor boasts about performance, or you are worried about the latest headlines affecting the S&P 500, take a deep breath, remember your benchmark isn’t based on these external factors, but rather on the achievement of your life’s dreams.