Tax-centric approach to building your ideal financial future in the Bay Area

Our Personal CFO services are laser-focused on helping you grow and protect your wealth as you look ahead to retirement and beyond

Investment Management

Investment Management is more than just building a portfolio. It is the integrated management of all investment elements to maximize the probability of clients achieving what is important to them while managing the risk and tax elements of the portfolio.

The focus of investing should be to achieve your goals.

Strategies for each client are directly aligned with risk capacity, account size, and future funding expectations.

This personalization also means we can leverage tax loss harvesting to add additional value. Tax loss harvesting can improve after-tax returns for investors with concentrated stock positions or who want to limit their overall tax obligation.

Our structured investment approach was developed to minimize your worry and enhance your income, growth, and tax treatment through the implementation of long-term strategic investment portfolio management.

Service Details:

-

Independence and Fiduciary Standard

We are completely focused on you and your best interests. As an independent, fee-only Registered Investment Advisor, we receive our compensation solely from you. We do not sell any insurance or investment products. Nor do we receive any commissions or accept any referral fees.

-

Preparation of Investment Policy Statement

We enjoy getting to know you and sharing our knowledge and expertise. We make specific recommendations for how to invest your funds, giving thoughtful consideration to your short and long-term goals, risk tolerance and constraints, current investment capital, inflation, the income tax impact of your choices, and your cash flow needs.

-

On-going Support

We are here for you as a trusted advisor to be a sounding board, to guide, to educate, and to fine-tune your financial plan as life events occur and/or new goals arise. We strive to keep you focused. Fear, greed, indifference, impatience, poor discipline, and lack of information are an investor’s worst enemies. Let us protect the investment plan you’ve adopted so you can focus on the more important things in life.

-

Global Asset Allocation is Key

Investment performance is determined largely by your portfolio’s asset allocation. We will develop your custom investment portfolio based on Nobel Prize principles and peer-reviewed academic evidence, to deliver the highest potential return per level of risk taken. The focal point of our philosophy is long-term, disciplined, globally diversified portfolio construction.

-

Custody at Fidelity Institutional

As our client, we will open your brokerage account with Fidelity Institutional Investments, one of the world’s largest investment management companies with a long-lived tradition of excellence.

Financial Independence Planning

Your financial future should make you feel in control, optimistic, and confident. That’s why we start with a clear-eyed view of each client’s current foundation, and then work to open the path toward their ideal future.

Our team is devoted to helping clients discover their vision. Then we explore thoughtful and creative ways for their financial resources to achieve it, both now and in the future.

Our process eliminates the problems that can occur when working with multiple advisors and eliminates the uncertainty of doing it yourself.

We don’t promise quick answers or easy solutions. Instead, we offer a prudent Process with a long-term focus that allows you to meet life’s most important goals.

It’s about you. We take the time to explore what’s important to you. Working alongside you, we provide total wealth management to simplify your finances.

Service Details:

-

Tri-Annual Meetings (March, Aug., Oct.)

Investment and tax review, Strategic Planning, and Tax Planning rounds out our proactive approach of building the future you desire.

-

Tax & Estate Planning Management

Annual tax planning and review of your Estate plan and asset titling lowers taxes over time.

-

Risk Management Insurance

Maximize your existing insurance policies and explore additional insurance when necessary.

-

Investment Management

Evidence-based investment advice tailored to your retirement, risk, and time horizon.

-

Charitable Giving

A long-term giving plan to accomplish your charitable goals and reduce taxes.

-

Retirement Modeling

Visualize your retirement plan and see how different scenarios can improve your retirement goals.

Tax Planning & Return Prep

Given our deep understanding of each client’s financial goals, we illustrate the tax implications of potential life changes to provide the financial, tax, and investment implications of these goals and how timing can be an important factor to consider.

Together with our affiliated company, Desmond Consulting Group, we address the many challenges faced by clients as they transition through the different phases of their lives.

We understand that taxes are often the largest expense that investors incur, therefore, we continually educate ourselves on the latest complex tax rules, regulations, and emerging laws which allows us to offer effective solutions, resulting in significant tax savings for our clients.

By integrating tax management throughout your Desmond Wealth Management experience, we take a “no surprise” approach for minimizing your tax obligations as we can, and budgeting for them as we must. We solve clients’ tax needs by completing returns and running tax projections to identify tax-wise steps to boost after-tax wealth over time.

Tax Services include:

-

Tax Planning and Preparation

When a tax law changes, we know about it. We believe in year-round tax planning to help minimize your current and future taxes. We also prepare all federal, state, and local tax returns for individuals, trusts, and businesses.

-

Business and Financial Consulting Services

We recognize that for most small business owners, their business is one of their largest assets. We partner with you to clarify your company’s direction, ensure your key employees are all “on the same page”, and map out the milestones required to meet your own personal life and financial objectives.

Create your life and financial plan by design, not by default

Failure to plan could result in:

Disorganization

Uncertain future

Missed opportunities

Excess or unknown risk

Leaving Uncle Sam a very large tip!

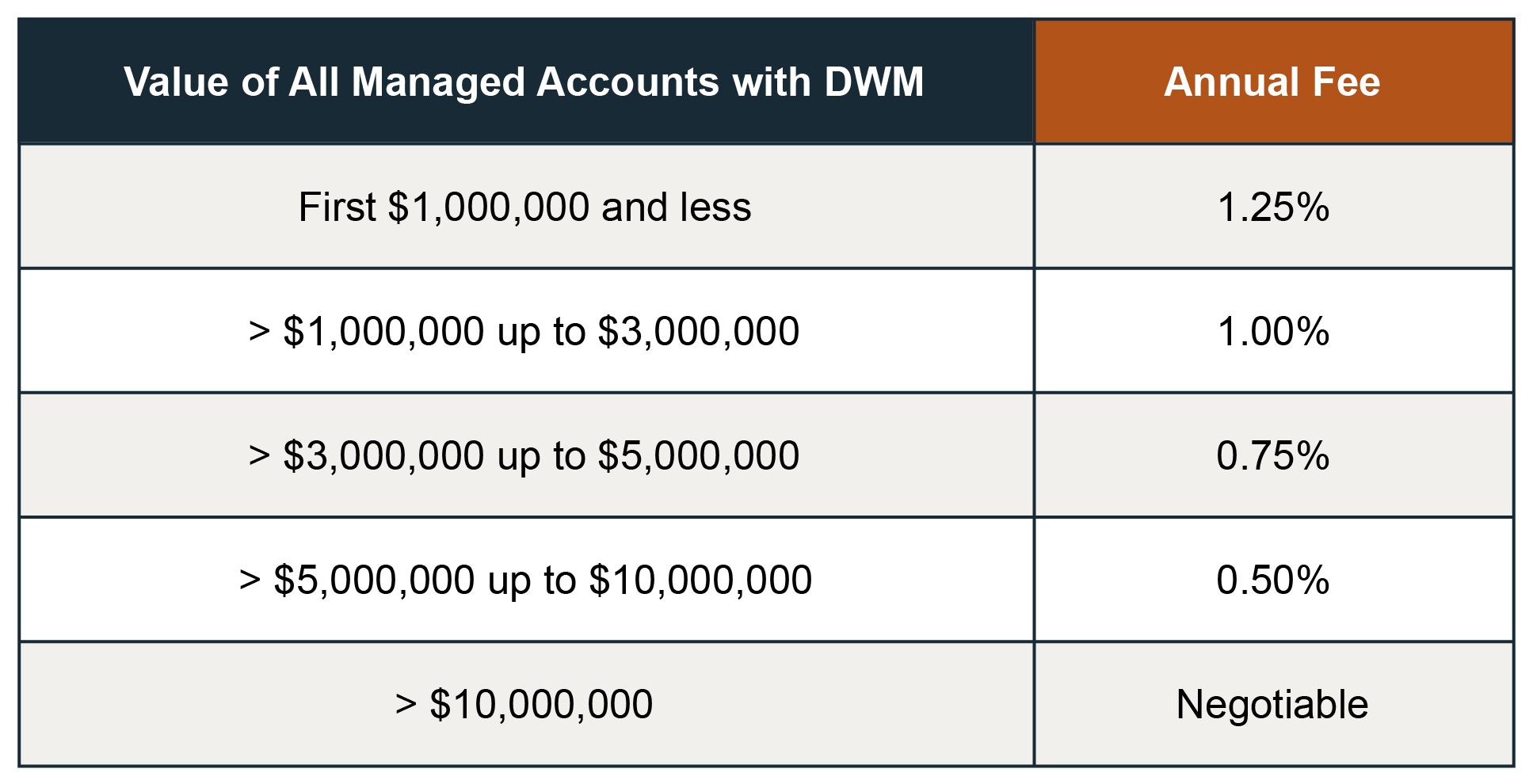

Fee for Service

Our ideal investment management client has a minimum of $2 million in assets available for management. If you have less than $2 million but are sitting on an equivalent amount of vested options, upcoming inheritance, real estate transactions, or business sales, let’s talk.

Our minimum annual fee is $22,500, subject to a minimum quarterly fee of $5,625.

Simple 3-Step Process To Get You Started:

-

This 15-minute call provides an opportunity to learn if your needs match our expertise.

-

The goal of this meeting is to get perfectly clear on your goals, values, concerns, and unique financial situation.

We talk less, ask more through open and curious inquiry, and actively listen. We want to really get to know you and what makes you tick.

Your answers to our questions, along with the documents we request you bring, will guide our analysis which will result in plain-English answers in our next meeting.

-

We review our findings and recommendations that are specific to you. We explain exactly what you should consider in order to achieve the financial goals that are unique and important to you, such as:

Can you afford to retire?

Are you giving Uncle Sam a larger Tip than required?

Will your portfolio replace your employment earnings?

Protecting your assets from creditors and predators?

At the end of this meeting, and if it makes mutual sense, we will explain our fees, and the next steps, and then ask if you would like to become part of our client community.

AS YOUR FINANCIAL GUIDE

“Our mission is to simplify finances so our clients can live the life of their dreams. While our clients are living their lives, we are monitoring their investments, and taxes, and developing financial strategies to ensure their dreams become reality.”

-Gregory M. Desmond, CPA/PFS, CFP® Founder and Principal of Desmond Wealth Management, Inc