Is the Stock Market Divorced From Reality?

Submitted by Desmond Wealth Management, Inc. on September 13th, 2020

For many of us, the daily routine has changed dramatically from a year ago. The near future offers little reason to expect any change.

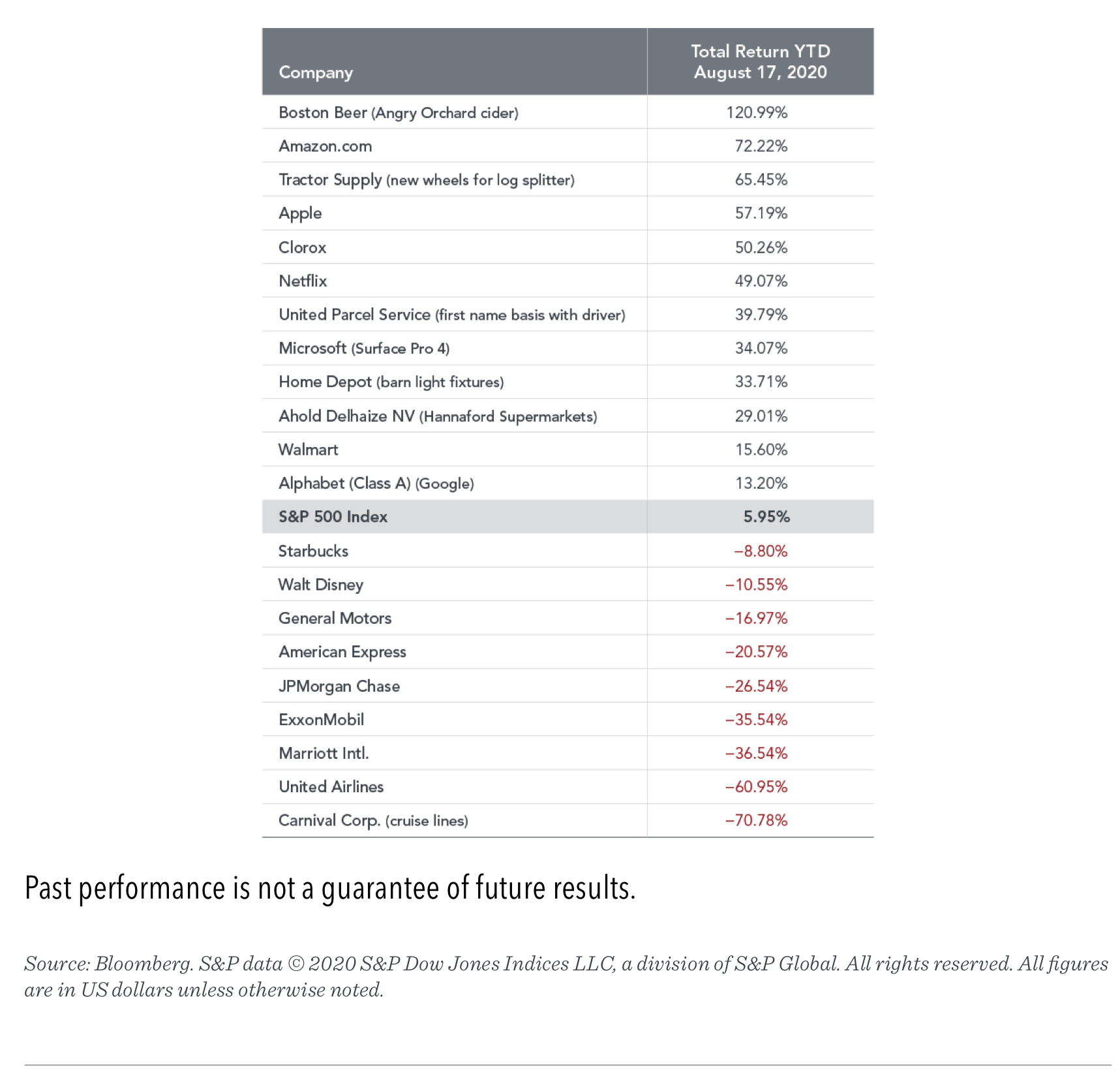

With this shifting landscape in mind, it shouldn’t be surprising that some companies have prospered during this upheaval while others — especially travel-related firms — have struggled. From its record high on February 19, 2020, the S&P 500 Index1 fell 33.79% in less than five weeks as the news headlines grew more and more disturbing. However, the recovery was swift, as well: from its low on March 23, the S&P 500 Index jumped 17.57% in just three trading sessions — one of the fastest snapbacks ever among 18 severe bear markets since 1896. As of August 18, 2020, the S&P 500 Index had recovered all of its losses and notched a new record high.

Many individuals are puzzled by this turn of events. For those under the age of 75, the news headlines are likely the grimmest in memory: Millions have found themselves suddenly unemployed, and storied firms such as Brooks Brothers, Neiman Marcus and JC Penney have entered bankruptcy proceedings.

How can stock prices flirt with new highs while the news is so discouraging? One financial columnist recently observed that the stock market “looks increasingly divorced from economic reality.”2

Is it? Let’s dig a little deeper.

The stock market is a mechanism for aggregating opinions from millions of global investors and reflecting them in prices they are willing to accept when buying or selling fractional ownership of a company. Share prices represent a claim on earnings and dividends off into perpetuity — current prices incorporate not only an assessment of recent events but also those in the distant future. In some sense, the stock market has always been “divorced from reality” since its job is not to report today’s temperature but what investors think it will be next year and the year after that and the year after that and so on.

Moreover, the universe of stocks does not march in lockstep. At any point in time, some firms are prospering while others are floundering. This year’s wrenching economic turmoil has inflicted great hardship on some firms while opening up new opportunities for others. Based on this admittedly abbreviated list, it appears the stock market is doing just what we would expect — reflecting new information in stock prices.

No one could have predicted the tumult we have seen this year in financial markets, but investors would do well to focus on what hasn’t changed.

1. Markets are forward-looking, so focusing on today’s economic data is akin to looking at the rearview mirror rather than the road ahead.

2. Broad diversification makes it more likely that investors capture market returns that are there for the taking — including companies that do far better than expected.

3. Since news is unpredictable, a strategy designed to weather both expected and unexpected events will likely prove less stressful and easier to stick with.

Bottom line: read the newspaper to be an informed citizen, not for advice on how to navigate the financial markets.

As always, if you have any questions or need assistance with navigating the road ahead, please feel free to give us a call.

1. S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

2. Matt Phillips, “Repeat After Me: The Markets Are Not the Economy,” New York Times, May 10, 2020.